is deflation literally satan?

I've been inspired to start writing this post thanks to this discussion under Most Salvadorans have already ditched their national Bitcoin wallets. You may notice the HN post is a few days old, that's because I've postponed posting due to fear of looking stupid. The reason I'm posting anyway is that I'm an avid reader of Dan Luu and was reminded of one of his posts that encouraged me to Just do it.™ The purpose of this post is to fire and forget. I may come back to this topic in the future.

Background

The thought of deflation benefits has been coming back to me ever since my introduction to economics in high school. I wasn't convinced by the reasoning of my teacher, reasoning which I don't even remember now, though I remember learning about deflation while also hearing words like the gold standard and mercantilism. These words don't seem relevant to deflation now as they did back then. Maybe that's why I keep thinking about it.

Proposal

I propose for central banks of the world (and the FED) to maintain inflation in the -1%,1% interval, rather than 1.5%,2.5%. Also there should be equal effort at both ends to stay within these bounds, as both high inflation and high deflation are equally dangerous.

The pragmatism argument

I believe the real estate market would benefit from deflation, right now it doesn't make much sense to sell properties, making the real estate market really hot. Raising interest rates does help on the demand side of the economic scissors, but there needs to be other kind of pressure.

I also believe that 2.5% inflation is already too high and affecting disproportionately the working class, mainly by wages not keeping up with it. Deflation fixes this.

Another benefit would be the lack of need to deal with devaluation of the currency, having to either discontinue bills and create new ones or doing a Redenomination creates unnecessary strain on the population.

The naturalism argument

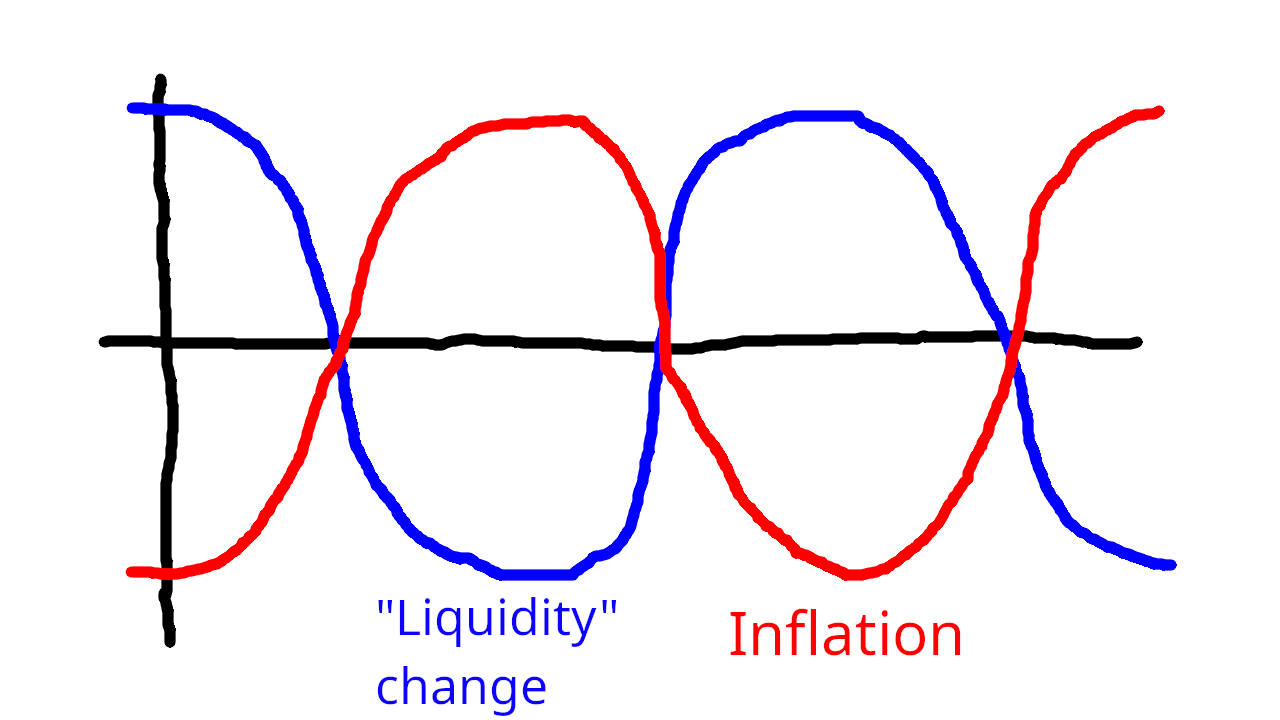

I've always liked symmetry, maybe too much sometimes, and the vision of the inflation chart showing some sort of naturally occuring pattern, like breathing or a heartbeat, was alluring.

For all people and even companies, there's periods of investment and periods of cutting expenses, let's create an aggregate of this behavior over the whole population. I'm thinking of a perfect state, where the "sinusoid" of inflation rate is exactly offset by the "cosinusoid" of this aggregate, creating a push-and-pull effect, forcing the populus to save money during peak inflation and spend during peak deflation.

Implementation

Obviously I don't know what I'm saying and if this policy is even implementable. How could this delicate balance work in the real world? I don't know, I think this whole theory may crumble when met with the fact that there isn't one currency, but many competing currencies on ForEx.

Conclusion

There's a lot of information (and education) I'm missing that could make this whole theory fall apart:

What is the relation of inflation and the central bank interest rate?

How does the currency issuing entity slot into this relationship, and what changed when ForEx entered the arena?

How do central bank reserves function and are there any anymore?

What I don't have is desire to delve into this rabbit hole to find out (at the moment). The reason I'm posting this to the internet is that maybe someone educated in the matter will either:

Effortlessly dismantle my theory with facts and logic.

Point me to the right materials so I can dismantle it myself.

Also, It's just future reference for me to see how stupid I was at 25 years of age.